Content

Although you can prepare a trial balance at any time, you would typically prepare a trial balance before preparing the financial statements. The trial balance is a report run at the end of an accounting period, listing the ending balance in each general ledger account. After analyzing transactions, recording them in the journal, and posting into the ledger, we enter the fourth step in the accounting process – preparing a trial balance.

Pepper’s Inc. totalled up all of the debits and credits from their general ledger account involving cash, and they added up to a $11,670 debit. After the above entries have been posted to the appropriate general ledger accounts, you are now ready to run an adjusted trial balance, which will reflect the updated balances. Once adjusting entries are made, you will need to run an adjusted trial balance, which will display the new ending balances of all of the general ledger accounts. The debits and credits in the trial balance should include all business transactions for the time period the trial balance covers.

The Trial Balance Is Blind To Other Kinds Of Errors

After you finish entering all of the balances from your ledgers, you will need to add them up to ensure that both the debit and credit columns balance. The purpose of a trial balance is to ensure that all debit transactions entered into the general ledger equal all of the credit transactions that have been entered. The following video summarizes what elements are included in a Trial Balance and why one is prepared. The trial balance is the edit phase of our story before we publish the results in financial statements. By checking this, if an accountant finds that the trial balance does not agree, any differences can be investigated and straightened out prior to crafting the financial statements. A trial balance ensures that for every debit entry, there is a corresponding credit entry recorded in the books, which is the basis of double-entry accounting.

Then, you balance each account once you record all the transactions in the ledger.Following this, you prepare a Trial Balance statement using balances from each of the ledger accounts. The very purpose you prepare a trial balance is to verify the correctness of your double-entry bookkeeping. If debit and credit totals match, you can move on to analyzing ending balances for discrepancies.

Accounting Trial Balance Example And Financial Statement Preparation

If your debits and credits are unequal, you must find ways to balance the accounts. You could have unequal debits and credits as a result of incorrectly posting accounting entries, forgetting to record an account, or miscalculating. Modern accounting software like QuickBooks, myBooks has the ability to generate trial balances with a click of a button at any point in time. When the difference between debit and credit totals is evenly divisible by 9, this is a mathematical indicator that the account balances may include a transposition error in one of the accounts. A mismatch between debit and credit totals in the trial balance usually means that one or more transaction postings from journal to ledger are either in error or missing. Accountants may ultimately have to examine every debit-credit pair of journal entries to find the mistake. That is because the total of debit balances equals the total of credit balances.

What is meant by balance b d?

Balance b/d stands for ‘brought down’ — the one carried forward from the previous accounting period, an opening balance is referred to by this. … Balance c/d stands for ‘carried down’ — the one carried down from the ledger to the next accounting period, a closing balance is referred to by this.

Find out what you need to look for in an applicant tracking system. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs.

Small Business Communication Tools And How To Choose One

Basically, your trial balance is an unrecognized hero necessary for decision-making. You need to adjust accounting entries to prepare financial statements. And, you need financial statements to make decisions about your business, secure funding, and more. The purpose of a trial balance is to ensure all the entries are properly matched. If the trial balance totals do not match, it could be the result of a discrepancy or accounting error.

Further, your trial reveals the unadjusted and adjusted balances of various ledger accounts. You need to make adjustment entries in case of any accounting errors, as stated above. Remember, your general ledger accounts are recorded in the following order in your trial balance sheet. It is important for you as a business to tally your trial balance sheet. This means that both the debit and the credit journal entries for each of your financial transactions have been recorded correctly. However, the balancing of your trial balance does not imply that your accounting records are accurate.

Note that each account carries one kind of balance only, either a credit balance or a debit balance. Thirdly, account balance calculations include other errors in data entry or mathematics. If totals are equal, it still does not fully guarantee that no errors were made; for example, when a transaction was recorded twice or when it was not recorded at all. Trial balance helps you to ensure the arithmetical accuracy of your general ledger accounts. So, let’s try to understand the uses of the trial balance sheet. We’ll do one month of your bookkeeping and prepare a set of financial statements for you to keep. Keep in mind that all of the accounts in your general ledger will be included in your trial balance, so the more accounts you have set up, the longer your report will be.

Format And Methods Of Preparing Adjusted Trial Balance

The second method is simple and fast but less systematic and is usually used by small companies where only a few adjusting entries are found at the end of accounting period. In this method, the adjusting entries are directly incorporated to the unadjusted trial balance to convert it to an adjusted trial balance. Further, the short-term liabilities appear before the long-term liabilities under the head ‘Liabilities’ in your trial balance. Also, the balances pertaining to assets and expenses are represented in the debit column. Whereas the balances related to liabilities, income, and equity are shown in the credit column. Understanding the trial balance is crucial if you handle your business’ accounting system manually. But if you’d rather leave that work to an expert, consider using a service like Bench.

The balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting. Debit BalanceIn a General Ledger, when the total credit entries are less than the total number of debit entries, it refers to a debit balance. A debit balance is a net amount often calculated as debit minus credit in the General Ledger after recording every transaction.

A Basic Accounting Tutorial For New Small Business Owners

Record each ledger account in the debit or the credit column of your trial balance sheet. In trial balance example such a case, you must record such an account as nil or zero in your trial balance sheet.

Furthermore, the number of transactions entered as the debits must be equivalent to that of the credits. Expense accounts are the last items to be included in a trial balance.

The unadjusted trial balance on December 31, 2015 and adjusting entries for the month of December are given below. Preparing a trial balance is the initial step in preparing the basic financial statements. These statements include trading and P&L accounts and the balance sheet of your company. Trial Balance is a statement that helps you to verify the accuracy of your ledger accounts. This is because it not only helps in determining the final position of various accounts. Thus, it becomes easy for you to prepare the basic financial statements. This is because you take the final balances from the trial balance itself.

For example, many organisations use trial balance accounting at the end of each reporting period. A general ledger is the record-keeping system for a company’s financial data, with debit and credit account records validated by a trial balance. A trial balance is a worksheet with two columns, one for debits and one for credits, that ensures a company’s bookkeeping is mathematically correct. Should an account have a negative balance, it is represented as a negative number in the appropriate column. For example, if the company is $500 into the overdraft in the checking account the balance would be entered as -$500 or ($500) in the debit column.

- However, you may wrongly treat it as a revenue expense if you debit the maintenance and repairs account with such an amount.

- A trial balance typically consists of a worksheet with two separate columns that account for the debits and credits that a company incurs throughout a certain period of time.

- Any material errors in the account balances they do not find and fix before publishing financial statements may result in an external auditor’s opinion that is either “Qualified” or “Adverse.”

- It gives you a snapshot of the accounting transactions of your business to the accountants and auditors.

- Liabilities and equity have credit balances and so their balances are included in the third column related to credit balances.

- A successful trial balance notwithstanding, accountants will still check carefully for the other kinds of accounting errors that do not impact a trial balance.

Account or categories name followed by debit and credit column. Exhibit 1 below shows the significant steps in the accounting cycle. Firms complete the entire sequence once every accounting period. Here, note that accountants create a trial balance after posting all the period’s transactions to the general ledger but before they transfer account balances to the period’s financial reports. As you can see, the accounts are listed on the left, with their balances on the right.

If a trial balance is in balance, does this mean that all of the numbers are correct? It is important to go through each step very carefully and recheck your work often to avoid mistakes early on in the process. Let’s now take a look at the T-accounts and unadjusted trial balance for Printing Plus to see how the information is transferred from the T-accounts to the unadjusted trial balance. Accounts are listed in the accounting equation order with assets listed first followed by liabilities and finally equity. A trial balance is a point in time report, meaning it is only valid for the specific time on which the report is prepared.

If you’re using accounting software, you can still run a trial balance at the end of the accounting period to ensure that your ending balances look right. When the trial balance does not balance, try re-totaling the two columns. If this step does not locate the error, divide the difference in the totals by 2 and then by 9. If the difference is divisible by 2, you may have transferred a debit-balanced account to the trial balance as a credit, or a credit-balanced account as a debit. When the difference is divisible by 2, look for an amount in the trial balance that is equal to one-half of the difference.

60% of smartphones in U.S. are 5G — Baker – FierceWireless

60% of smartphones in U.S. are 5G — Baker.

Posted: Wed, 01 Dec 2021 16:55:57 GMT [source]

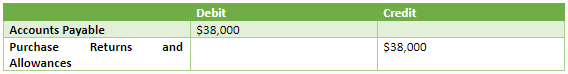

Suppose a company has a cash account with a balance of $1,750, accounts receivable of $250, accounts payable of $1,500, and stockholder equity of $500. The trial balance lists the closing balances of the accounts from the general ledger as of a specific date. The trial balance is a report used in bookkeeping in which the balances from the general ledger are recorded. You put account payable balance at the credit side and put receivable at the debit side of the income statement. Finally, if some adjusting entries were entered, it must be reflected on a trial balance. In this case, it should show the figures before the adjustment, the adjusting entry, and the balances after the adjustment.

The debit column shows $2,000 more dollars than the credit column. Note that for this step, we are considering our trial balance to be unadjusted. The unadjusted trial balance in this section includes accounts before they have been adjusted. As you see in step 6 of the accounting cycle, we create another trial balance that is adjusted . The firm may enter a transaction in the correct kind of account (e.g., “Asset account” or “Expense account”) but still choose an incorrect account within the category. The contributions total debits and total credits will be equal.

You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Limited or its affiliates. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.

It summarizes all the ledger accounts balances in one statement. Once the report time point is identified, it is important to gather all the balances of every account or category in your accounting system. Usually assets, expense categories will have debit balance and liability, equity and income categories will have a credit balance.

Author: Ken Berry